tax liens in dekalb county georgia

There are more than 10069 tax liens currently on the market. Payoffs and other lien information can be viewed using the Georgia Tax Center.

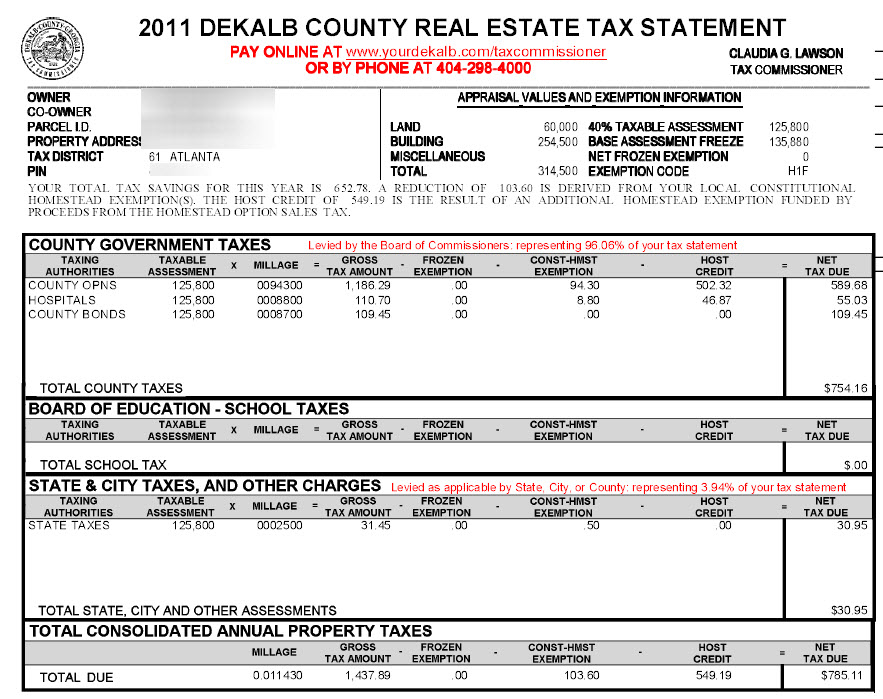

Atlanta Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

15 029 01 117.

. Georgia Requires Tax Parcel Identification for all DeKalb Property Transfer or Conveyance Filings as of July 1 2019 in accordance with House Bill 694 HB 694. Our real estate records date. Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate.

Find Information On Any DeKalb County Property. Ad Find The Best Deals In Your Area Free Course Shows How. This is a period of time in which the former owner can reclaim the property by repaying the amount bid at the Dekalb County Tax Deeds Hybrid sale plus None 20 penalty of the.

Search Any Address 2. Ad Buy Tax Delinquent Homes and Save Up to 50. Search all the latest Georgia tax liens available.

When the lien is issued the county or town that is owed property taxes. Penalty and Interest on Delinquent Returns Returns and. Display County Index Data Good FromThru Dates.

Any dealer with four or more locations must file their Sales and Use Tax Return on the Georgia Tax Center httpsgtcdorgagov. DeKalb County Property Records are real estate documents that contain information related to real property in DeKalb County Georgia. Shop around and act fast on a new.

Releases of Property Subject to State Tax Liens. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. See Available Property Records Liens Owner Info More.

Go to httpsgtcdorgagov and select SOLVED. 6758 BROWNS MILL LAKE RD. Search Any Address 2.

TOTAL Taxes Due. Property Tax Online Payment Forms Accepted. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

Pursuant to HB1582 the Authority is. A tax lien is a claim or encumbrance placed on a property that authorizes the Tax Commissioner or the Sheriff to take whatever action is necessary and allowed by law to obtain overdue taxes. Georgia Tax Lien Homes.

In fact the rate of return on property tax liens investments in. Dekalb County GA currently has 3075 tax liens available as of March 31. Public Property Records provide information on.

Debit Credit Fee 235 E-Check Fee FREE. Buying tax liens at auctions direct or at other sales. J R MCBRAYER LLC.

Property tax liens are used on any type of property whether its land your house or commercial property. 15 006 01 019. Search the Georgia Consolidated Lien Indexes by County book and page.

Ad Ownerly Is A One Stop Shop For All Your Homeowner Questions. 11 248 03 020. Dekalb County GA tax liens available in GA.

Ad Find DeKalb County Online Property Taxes Info From 2021. Search for pending liens issued by the Georgia Department of Revenue. Find the best deals on the market in Dekalb County GA and buy a property up to 50 percent below market value.

For individuals enter last name first name Display Results From optional. Check your Georgia tax liens. Tax Commissioners Office provides payoff amount interest fees Petitioner is notified of the payoff amount and Petitioner provides 75 cashiers check for processing fee made payable to.

15 043 09 035. Register for 1 to See All Listings Online. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

Just remember each state has its own bidding process. Ad Ownerly Is A One Stop Shop For All Your Homeowner Questions. See Available Property Records Liens Owner Info More.

Self Employed Home Buyer Business Tax Profit And Loss Statement Business Person

Have A New Home Here 39 S How To Apply For Homestead Exemption In Georgia This Will Reduce Your Property Taxes An How To Apply Real Estate Tips Homesteading

Tax Sale Listing Dekalb Tax Commissioner

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

25317 Highway 22 Sparta Ga 31087 Little Dream Home Renting A House Little Houses

Tax Sale Listing Dekalb Tax Commissioner

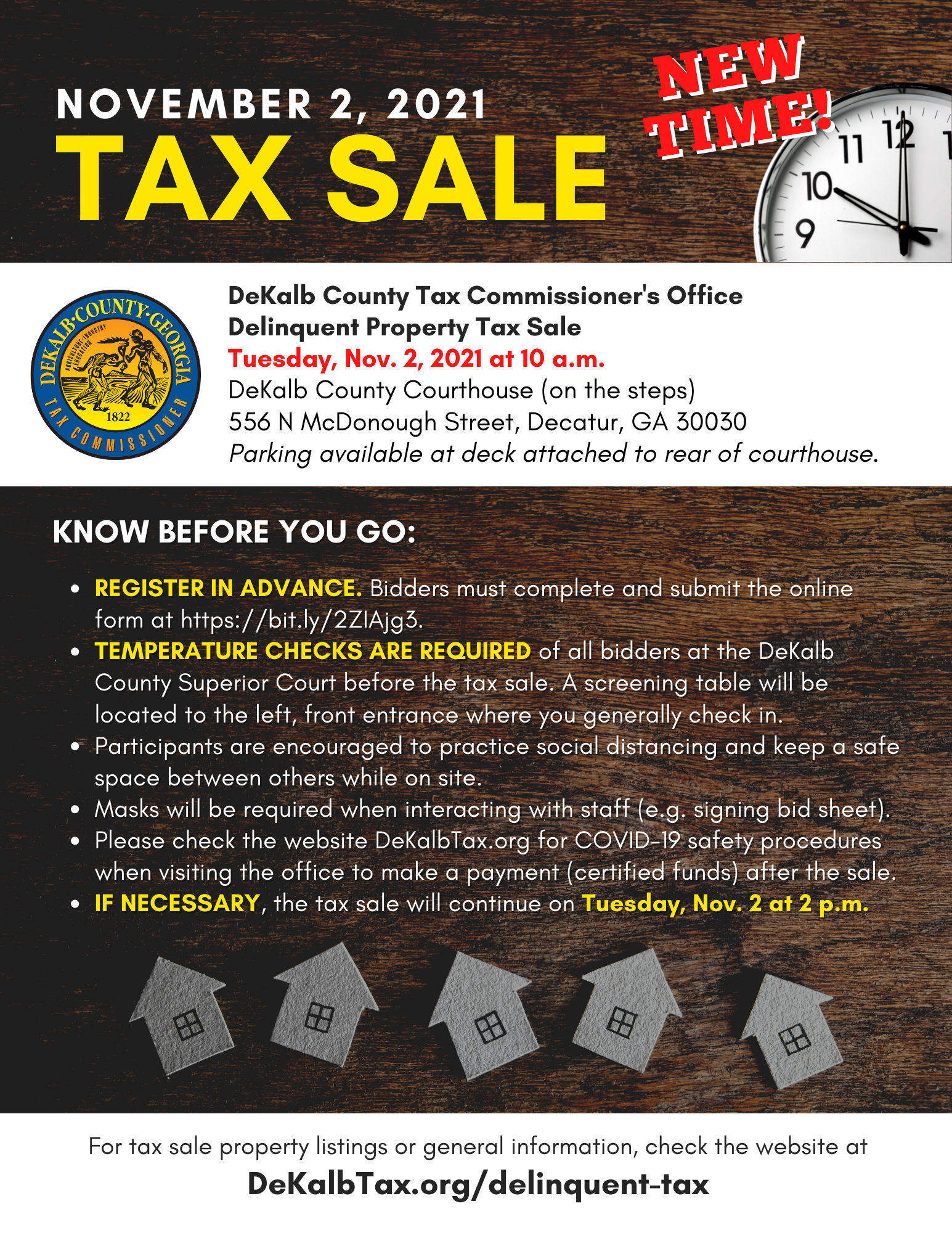

Tax Sale New Time Dekalb Tax Commissioner

Delinquent Property Tax Dekalb County Ga

Tax Sale Listing Dekalb Tax Commissioner

2147 Ector Ct Ne Atlanta Ga 30345 Mls 6555139 Coldwell Banker House Styles Coldwell Banker Briarcliff

City Of Thomaston Ga Historical Building In Downtown Thomaston Georgia Was Cotton Warehouse Historic Buildings Thomaston Property Records

The Official Legal Organ Of Dekalb County Georgia Atlanta Goodlife

Tax Sale Listing Dekalb Tax Commissioner

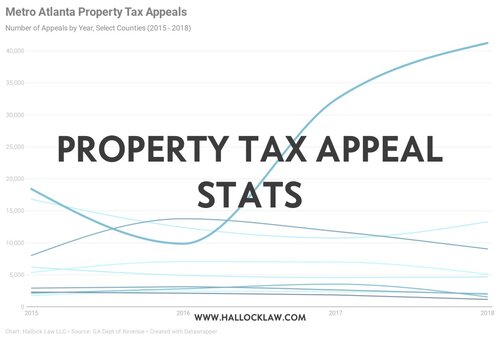

Dekalb County Ga Hallock Law Llc Property Tax Appeals

Forsyth County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Dekalb County School Staff Are Once Again Creating Misery For Parents As Lakeside Cluster Elementary School Att Elementary Schools School Attendance Elementary